China's Tech Giant Huawei Spans Much Of The Globe Despite U.S. Efforts To Ban It

The United States government doesn't want the Chinese technology giant Huawei to feel welcome almost anywhere. In the past year, the U.S. had the company's chief financial officer detained in Canada and temporarily cut off its access to American suppliers, endangering Huawei's ambitions to roll out the next generation of wireless networks around the world.

Now the Trump administration is seeking a global ban of Huawei's 5G equipment. It has even threatened to stop intelligence sharing with key allies such as Germany if they don't fall in line.

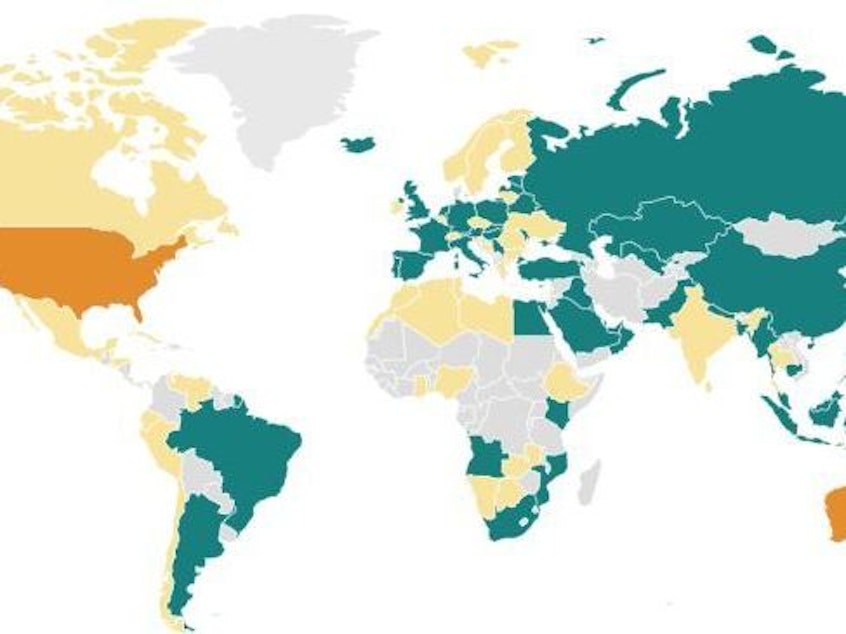

But Germany's government has pointedly resisted the pressure, and it is not alone. Much of Europe, Africa, the Middle East and the Americas will continue to set up 5G using at least some Huawei equipment. Some countries have directly pushed back against American pressure, declaring it their sovereign choice.

Huawei is the world's biggest telecommunications network equipment supplier. Since its breakout contract in 2009 to build a 4G network in Norway, it has expanded operations to more than 170 countries, raking in $107 billion in revenue in 2018. In the third quarter of this year, the company reported a revenue increase of nearly 25% year-on-year, thanks largely to smartphone sales, and said it has signed more than 60 contracts for 5G with international carriers.

The Trump administration alleges Huawei's global deals could open back doors for the Chinese government to gather intelligence in other countries, but it has offered no proof.

Sponsored

Huawei fiercely denies U.S. allegations that it spies or is too cozy with the Chinese government. Speaking at a conference in February, one of the company's top executives suggested the accusations may stem from America's own intelligence plans and referred to how U.S. spy agencies have conducted international surveillance through back doors in technology.

Still, 5G is so new that the U.S. has struggled to assess its potential for cybersecurity threats, analysts say. With the drafting of international standards starting in late 2016 and still ongoing, the network is in an early launch phase and is not yet widely available.

"Part of the honest dilemma is people don't know precisely what the risks will look like, but the Huawei question has jumped to the front of that discussion before the broader security assurance programs are really through," says Graham Webster, a technology commentator and editor at Stanford-New America's DigiChina project. "Other countries have found the U.S. leap [to ban Huawei] there quizzical, which frankly makes trying to convince people harder to accomplish."

Some analysts have framed this as a question of political allegiance to the U.S. "Faced with technological unknowns, the selection of equipment and service providers for 5G infrastructure is a matter of political trust; Europe needs to decide whether to extend that trust to the Chinese party-state," noted a March policy brief from the Mercator Institute for China Studies, a think tank that frequently advises the German government. "The key concerns in Europe are — and should be — independent of such a geopolitical U.S. push."

Meanwhile, Huawei has a baked-in 5G advantage in Europe, where it already has helped build out extensive 4G networks. That means countries that opt for faster and cheaper "non-standalone implementation" — building out the first wave of 5G on top of existing 4G infrastructure — have to incorporate at least some Huawei equipment or begin the expensive and complex task of extricating Huawei from their 4G networks, analysts say.

Sponsored

"That's why 4G is quite important to 5G implementation. It's also why you see pushback from countries like the U.K.," says Nikhil Batra, a senior research manager at research firm IDC in Australia.

The British government decided to allow companies to use Huawei equipment in only "non-core" elements of its 5G network and has set up an independent security screening body to assess the company's hardware and software security annually.

Other countries such as Bahrain and Cambodia have unreservedly embraced Huawei 5G. The company's services and products are consistently cheaper than those of competitors such as Nokia and Ericsson. Chinese state banks often partner to extend cheap loans to cater to smaller or developing countries willing to use Huawei equipment.

Only a few other countries — Japan, Australia and New Zealand — have barred Huawei 5G deals; many world powers remain undecided.

American officials cast the race to 5G as a quintessential national security competition, rather than a commercial one.

Sponsored

Critics of Beijing say international governments should be vigilant even when dealing with private corporations in China. The country's 2017 national intelligence law compels companies and individuals to help with intelligence-gathering, including turning over data on foreign citizens.

"I think it would be naive to think that that country [China] and the influence it has over its companies would act in ways that would treat our citizens better than it treats its own citizens," Robert Strayer, the U.S. State Department's top diplomat for cyber policy, said at a think tank event in February.

But in seeking a global ban on Huawei 5G equipment, the U.S. has taken a high-risk gamble: either manage to herd everyone else into prohibiting Huawei, or find itself outside the club.

The U.S. has already made dramatic moves to contain Huawei's 5G global rollout. In May, the Commerce Department blacklisted Huawei from doing business with almost any American company. That could have kneecapped Huawei, which buys critical components from a handful of U.S. semiconductor companies. But President Trump walked back the ban in June, at the Group of 20 summit in Osaka, Japan, by allowing American companies to apply for exemptions and sell to Huawei.

"By putting Huawei on an entities list to gain leverage in trade talks but then walking it back, Trump has made the U.S. seem like an unreliable supplier of technology," says Dan Wang, a technology analyst with Beijing-based economics research firm Gavekal Dragonomics.

Sponsored

Chinese technology companies are now seeking non-American alternatives to avoid having their supply chains disrupted once again, according to Wang, and U.S. tech companies are looking to move some production offshore to avoid future export bans.

"Trump's weakened the long-term strength of U.S. technology firms without having dealt a deathblow to Huawei," Wang says.

Lack of follow-through has opened up opportunities for Huawei to double down in existing markets and seek new places to set up shop.

Huawei may be preparing to fire hundreds of employees from its U.S. subsidiary Futurewei, The Wall Street Journal reported, and the tech company has begun moving American employees out of its Shenzhen, China, headquarters, according to the Financial Times. It is also barring Americans from attending public events hosted by its various Noah's Ark Lab research centers around the world, according to invitations seen by NPR.

Huawei is allocating resources and personnel elsewhere. This year, it announced expanding research centers in Switzerland and $3.1 billion worth of investment in Italy over the next three years. Italy promptly dropped proposed emergency legislation to ban Huawei from its 5G networks two days later. [Copyright 2019 NPR]